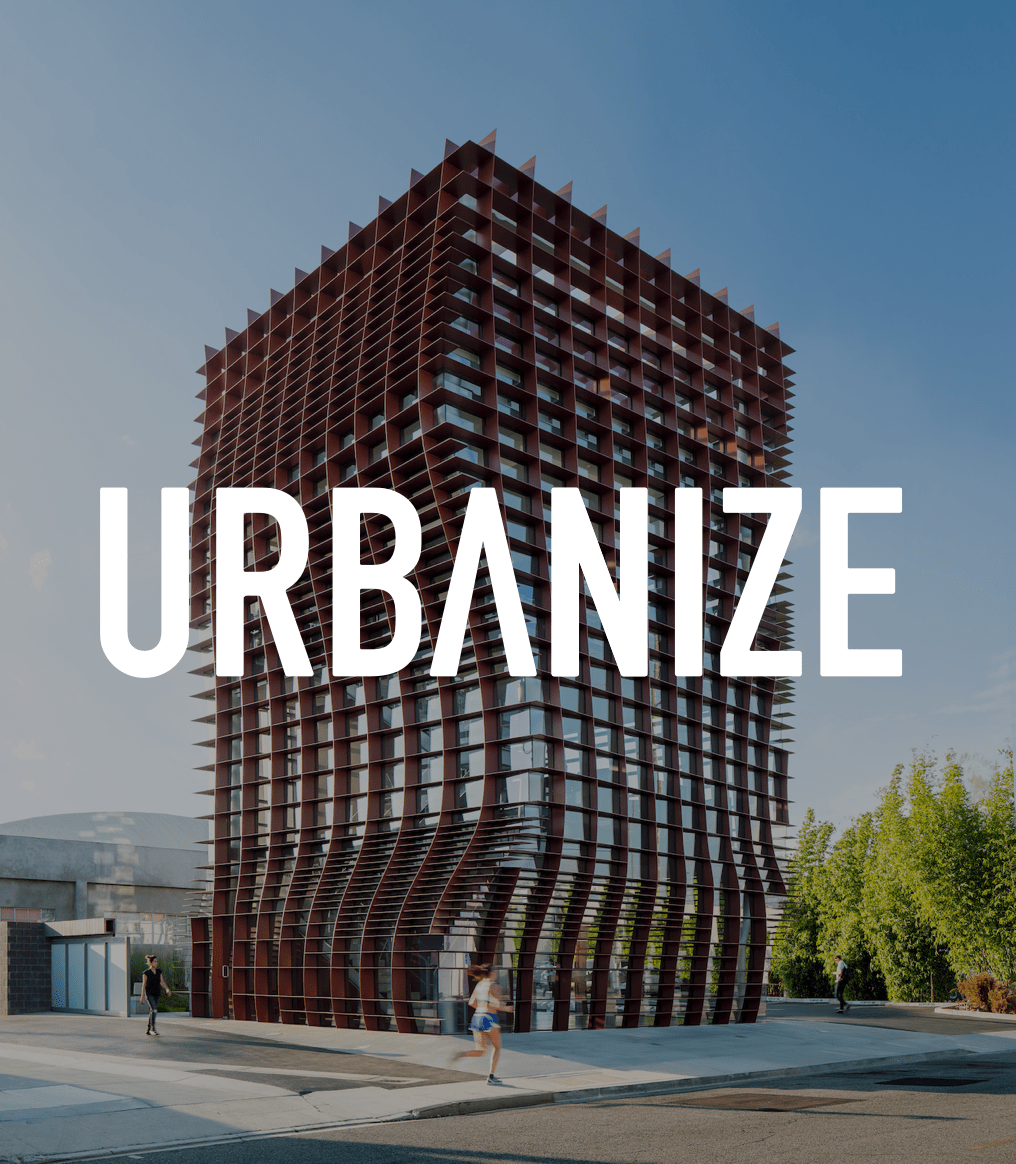

A short walk from the beach in Coney Island, a $133-million mixed-use development featuring affordable housing and commercial space has made its debut, Governor Kathy Hochul announced last week.

The 22-story building, named Raven Hall, includes 216 affordable apartments above 8,500 square feet of ground-floor retail space and a parking garage. The housing includes 77 apartments reserved for families experiencing homelessness.

“My administration will continue to confront the housing crisis through high-quality affordable housing projects that will improve the lives of residents and create vibrant communities,” said Hochul in a statement. “This $133 million mixed-use development in Coney Island will enhance quality of life for residents and the entire community, while building a stronger economic future for this unique, historic neighborhood.”

The building's affordable units are split between 193 apartments reserved for households earning up to 60 percent of the area median income (AMI), with an additional 222 units reserved for those making up to 90 percent of AMI. The project also includes one apartment for a building superintendent.

The supportive housing units will be accompanied by on-site services, provided by New Density, with funding from the Empire State Supportive Housing Initiative.

In addition to housing, Raven Hall includes amenities such as a community room with a terrace, a fitness center, a children’s play room, a laundry facility, and storage.

Raven Hall is the second phase of a seven-phase redevelopment of Coney Island’s Bath Site, a two-block site of mostly vacant sites located between the boardwalk and Surf Avenue. Its name derives from the Ravenhall Baths, a large saltwater pool in Coney Island that opened in 1867, but was destroyed in a fire in 1963.

The initial phase of the Bath Site redevelopment, Surf Vets Place, opened in 2019, creating 135 apartments for families and homeless veterans.

Financing for Raven Hall included $19 million in permanent tax-exempt bonds, as well as other state, local, and federal sources.

- Coney Island (Urbanize NYC)